Posted on: 16th July 2020 in Investments

Social distancing means we are less connected now than at any time in recent history.

Thankfully, video conferencing software has proven to be the digital hero of the pandemic.

Services such as Zoom, FaceTime and Skype have allowed businesses to operate and stay connected. Video calls have also been a way for us to socialise and feel connected to friends and family digitally.

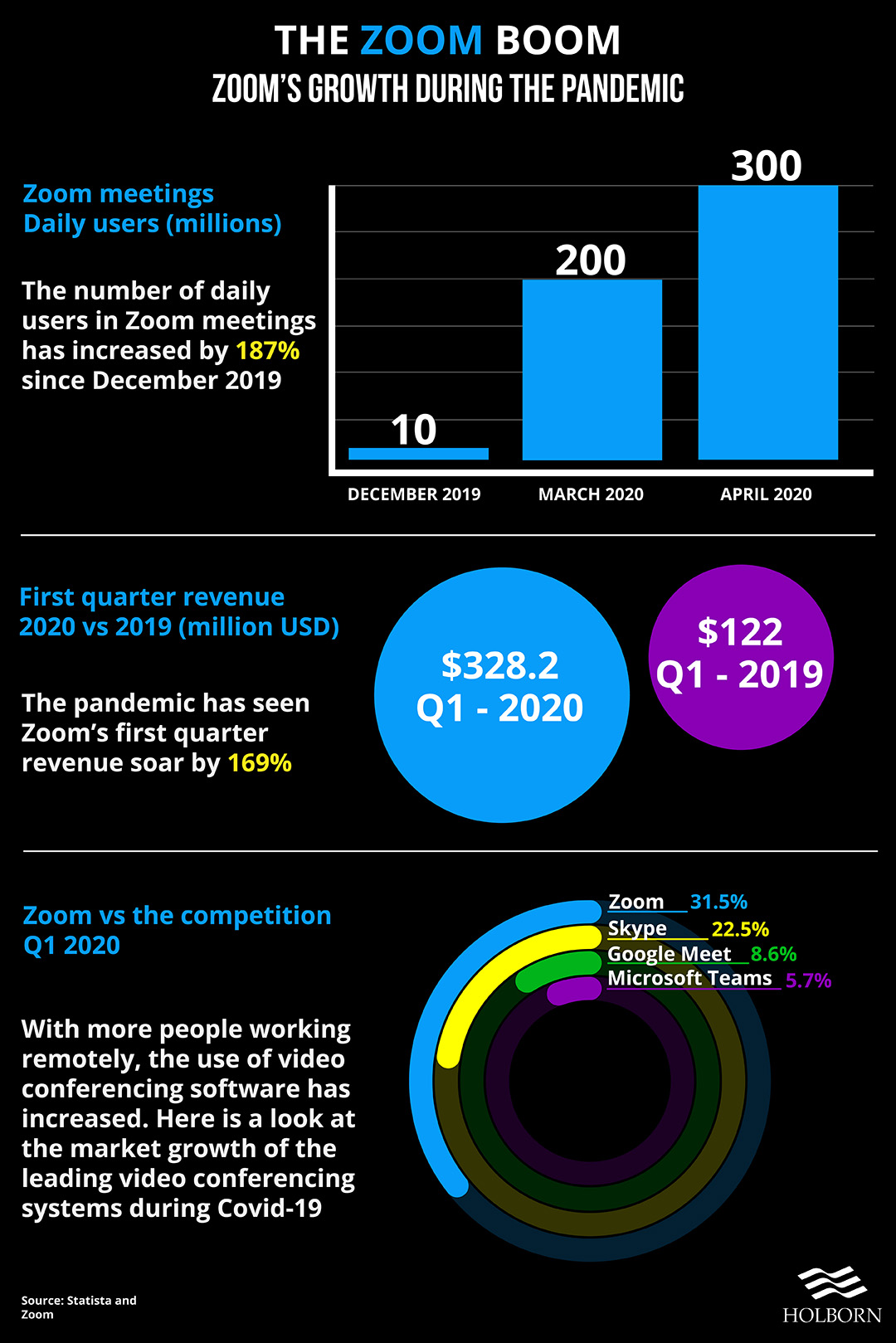

Within three months, Zoom went from a verb to a word that is now synonymous with video calling. As a result, Zoom’s revenue soared 169% in the first quarter of 2020.

If you are looking to invest, could video communication be an area to consider? Let’s find out.

We previously looked at the video gaming industry and its investment potential.

As investors look to grow their money, they will no doubt be looking at industries which appear to be Covid-19 proof.

Since the start of the pandemic, video conferencing has seen substantial growth. Zoom, in particular, has become the go-to for personal and business use.

Zoom has undoubtedly made some noise, and the competition has heard.

Zoom has emerged as the dominant player during the pandemic. However, Google and Facebook have both launched new measures to compete with Zoom.

Google recently announced its premium video conferencing software would be free to use. Google Meet was previously locked behind a paywall. With the service now rolling out to everyone, all users will need is a Google account.

Facebook also launched a range of new features to challenge Zoom’s dominance.

The company’s flagship feature is Messenger Rooms, which tackles one of the significant limitations of the service. Facebook video calls are currently limited to eight people. The introduction of Messenger Rooms will allow up to 50 people to join a call.

Microsoft has also looked to enhance its conferencing system.

New features introduced to Microsoft Teams look to make meetings more engaging. Together Mode will place participants in a virtual space such as a conference hall or coffee shop.

Video calls have almost become a necessity as the world looks to maintain some normality.

With social distancing, travel restrictions and other measures in place, video calls allow us to stay connected to friends and family. Video calls have also been vital for business.

Companies have been able to use video conferencing software to conduct meetings and create a virtual office from their home. The digital way of interacting has even spread to the classroom.

Schools, colleges and universities have all found a way to utilise video software to teach remotely.

As our reliance on video calls increases, so has the market value of the companies behind the software.

At the start of 2020, Zoom’s stock value was around $70 a share. At the time of writing, a share in the video communication company will cost just over $270.

The financial success of other video conferencing software is a little harder to track. That’s because Zoom’s competition is from software that falls under the umbrella of bigger corporations. Google owns Meet, whereas Teams and Skype are traded as part of Microsoft.

However, the rising share value of Microsoft could be linked to the company’s video software.

Microsoft’s stock price has been increasing since March when the lockdown began. The software giant’s stock price hit $213 in July, and Teams could be one of the factors.

Microsoft Team’s had a record 2.7 billion meeting minutes logged on March 31st. The same month saw video calls increase by 1,000%.

The big question is the long-term viability from an investment perspective.

Investors may worry that stock prices could plummet when regular service resumes. What happens when face-to-face meetings replace video calls?

This could be less of a concern than you may think.

Covid-19 has been an unexpected dry run to test the success of remote working. Many of us have adapted to our new home office environments, and we seem to be happy with this new way of working.

A report found that 87% of employees want more flexibility to work remotely. Of those, 21% would rather not return to the office at all. Only 13% of workers want to return to the office full time.

The unplanned remote working experiment has been successful for some business. Companies are now questioning the need for large office spaces as they look to save on costs.

The same report found that 44% of companies were considering reducing the size of their office space. Some companies have gone a step further after seeing how successful remote working can be.

Jack Dorsey, the co-founder and CEO of Twitter, recently announced that employees would be able to work from home permanently. The remote working model has also been extended to Square, Dorsey’s mobile payments company. Several other companies have since followed suit.

As businesses move to this new way of working, there will surely be a sustained need for software that keeps them connected with colleagues and clients.

Building a pandemic-proof portfolio may seem complicated, but achieving your investment goals is possible in any climate.

As the world changes, so do the tools we need to operate. Having the right strategies and building a diverse portfolio will allow you to take advantage of new investment opportunities.

To find out how we can help you build a Covid-proof portfolio, contact us using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

In South Africa, achieving financial security means more than just budgeting or saving. It requires a strategic approach that ensures your money grows and adapts to your needs and the...

Read more

In the world of investing, the old saying “don’t put all your eggs in one basket” couldn’t be more relevant. A diversified investment portfolio is essential for managing risk while...

Read more

When it comes to growing and protecting your wealth, portfolio management plays a vital role. But with so many approaches, knowing which one is right for you can be confusing....

Read more

In recent years, ESG (Environmental, Social, and Governance) investing has taken the financial world by storm. More than just a buzzword, ESG investing represents a fundamental shift in how we...

Read more